Ontario Reverse Mortgage Experts. Mortgages In Reverse!

Receive impartial advice on Ontario reverse mortgages from specialists in the field. Our collaboration extends to leading reverse mortgage lenders across Ontario, yet our commitment remains firmly with you, the client.

Step 1: Our conversation begins with an exploration of alternatives to reverse mortgages, ensuring you’re informed of all your options.

Step 2: Guiding you through the selection process, we identify the reverse mortgage lender that aligns best with your specific financial needs. Our expert assistance comes at no cost to you.

Our goal is to support your journey towards a comfortable retirement in the home you cherish.🚀

Get Unbiased Ontario Reverse Mortgage Advice

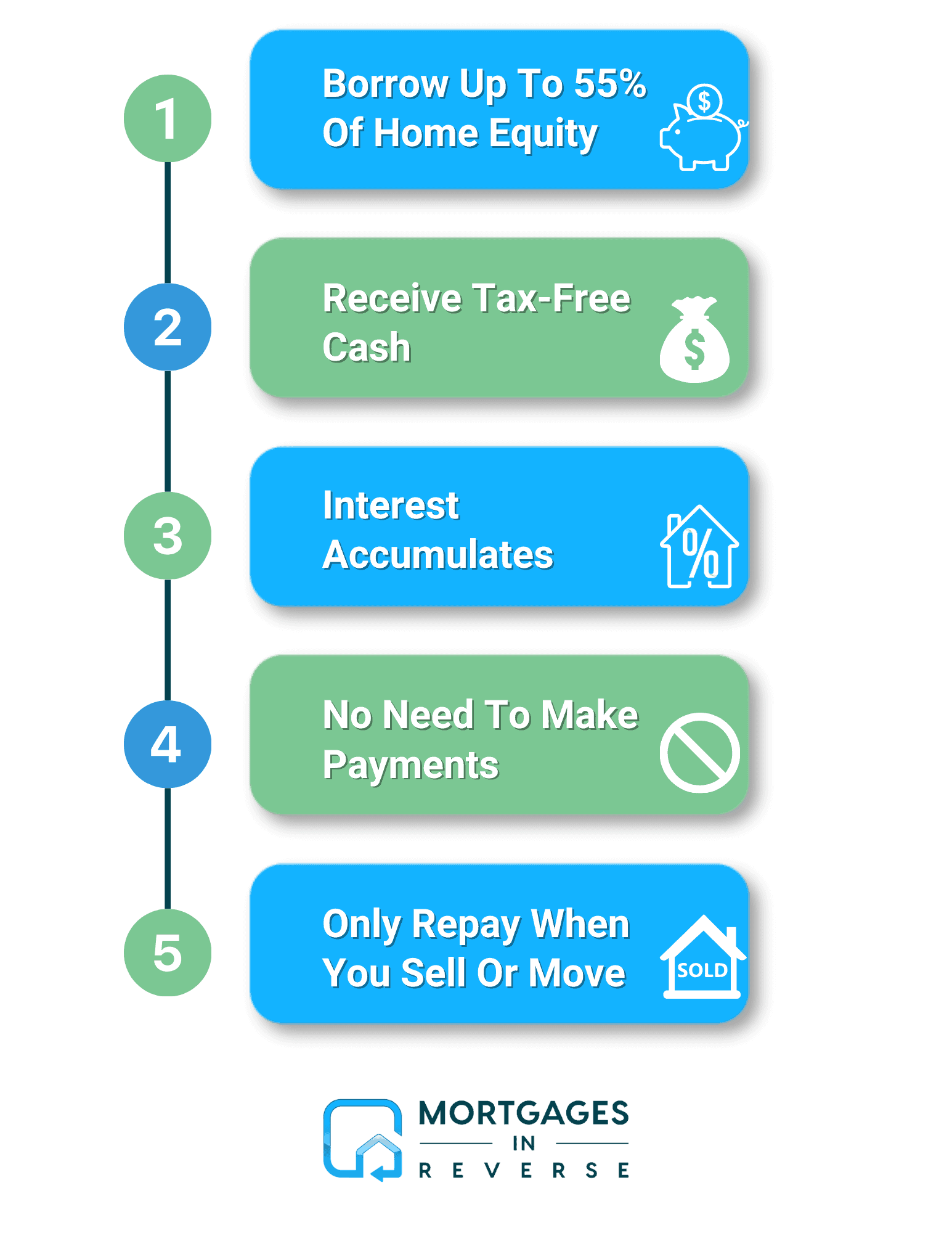

Access up to 55% of the Value of Your Home – No Monthly Payments Required!

Navigating reverse mortgages can be complex. Our team maintains strong relationships with premier reverse mortgage lenders across Canada, enabling us to efficiently identify the lender that perfectly matches your distinct borrowing needs and retirement plans.

Here are the most common uses for a reverse mortgage.

Supplement Your Monthly Income

Live within your monthly budget. Boosting your monthly earnings can enhance your standard of living.

Consolidate Debt - Pay Off HELOC

Leverage the equity in your home to eliminate high-interest debts, thereby permanently lowering your monthly expenses.

Home Renovations - Level Up Your Home

Utilize a Reverse Mortgage to refurbish or modernize your home, enhancing its comfort for Aging in Place.

Living Inheritance To Children

Unlock financial freedom by supplementing your monthly income directly from your home's equity!

Pay For Unexpected Health Costs

Life's journey is filled with unforeseen challenges. Having the financial flexibility to access additional health care when required can be a crucial safety net.

Purchase A Recreational Property

Leverage a Reverse Mortgage to use your home equity in purchasing the vacation home you've always dreamed of.

Turn Your Home Equity Into Tax-Free Cash. No Monthly Payments

Why Choose Us?

Get Unbiased Reverse Mortgage Advice

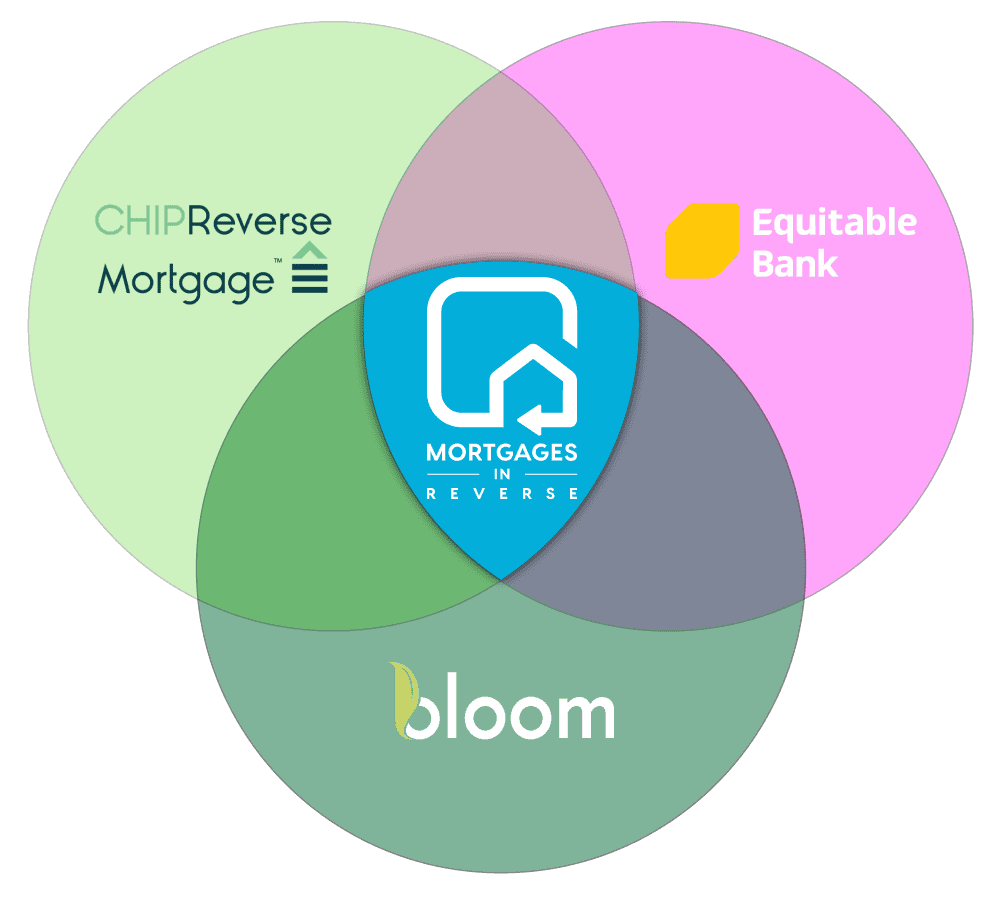

Canada has three reverse mortgage lenders: Chip Reverse Mortgage, Equitable Bank, and Bloom Financial. Each lender offers distinct advantages and potential drawbacks. Our role involves closely collaborating with these three lenders, and we endorse each of them for their unique contributions to the market.

Our primary responsibility is to assist you in comprehending the strengths and limitations of each lender and to obtain quotes from those that most closely align with your specific borrowing needs.

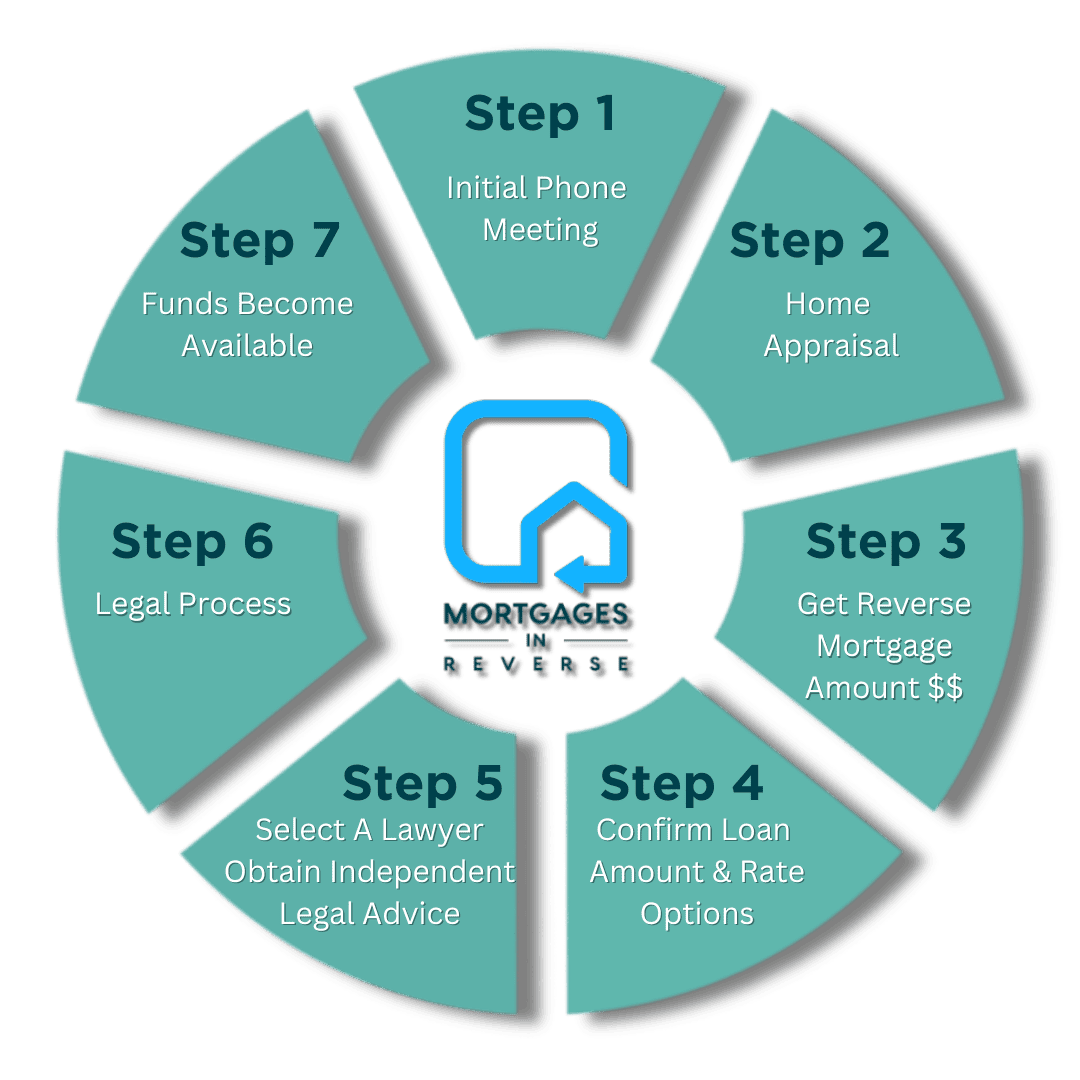

Reverse Mortgage Process

Take The First Step Towards A Better Retirement

At Mortgages In Reverse, we operate as independently licensed mortgage brokers, with our loyalty squarely placed with you, not with reverse mortgage lenders or banks. Our approach always includes exploring whether there are alternative lending solutions that could better serve your needs, before considering a reverse mortgage. Our mission is centered on guiding you towards the reverse mortgage option that best suits your situation.

We invite you to complete our brief contact form, and we’ll reach out to you shortly to discuss whether a Reverse Mortgage is the appropriate choice for you.

Get A No Obligation, Free Quote Today.

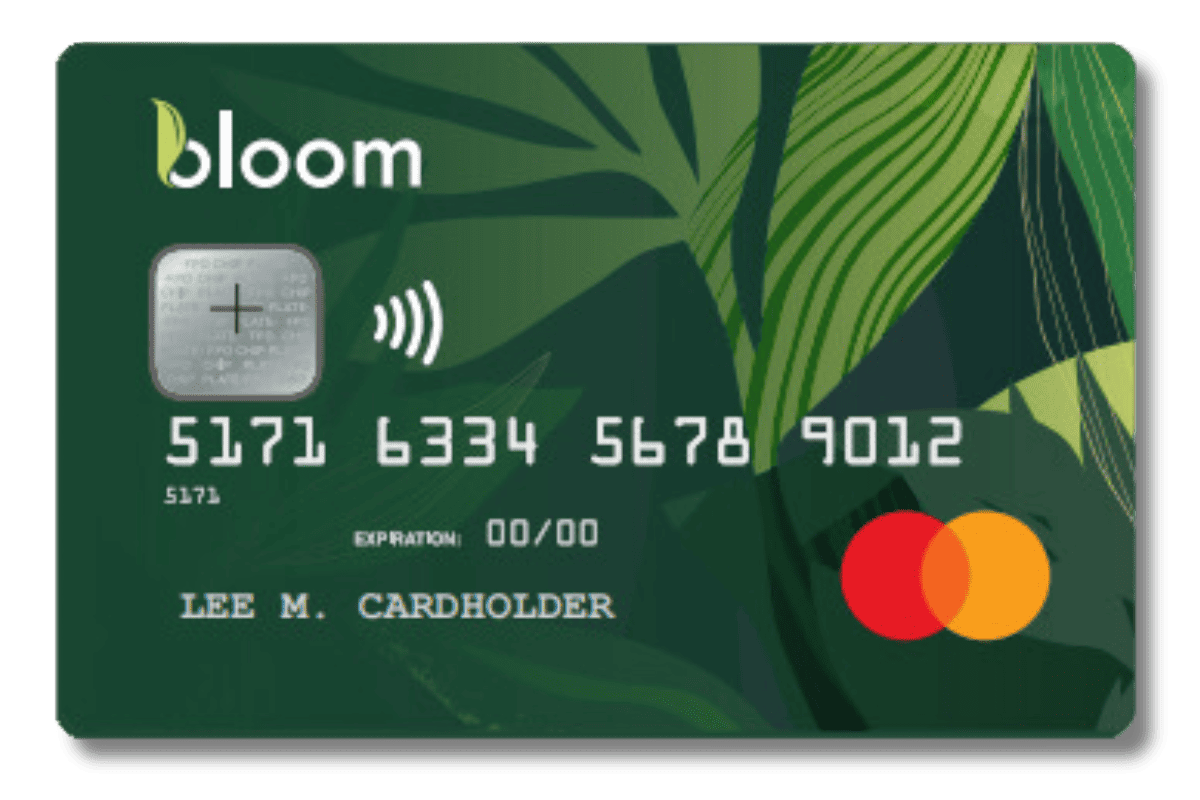

New reverse mortgage credit card

Apply For The New Bloom Reverse Mortgage Credit Card

Why Choose A Reverse Mortgage?

What Is A Reverse Mortgage?

No Payments. Ever.

Regardless of how long you live, there will never be a payment.

Protect Your Estate

Regardless of the outstanding balance or the future market value of your property, your estate will never be required to cover any deficit in the mortgage upon your passing.

Tax Free Income Supplement

Unlike from other retirement benefits, the monthly income generated from your Reverse Mortgage is completely tax-free. This means that neither you nor your estate will be obligated to pay taxes on this monthly revenue.

Get Unbiased Reverse Mortgage Advice For Free!

See What You Qualify to Borrow

Contact us today to find out if a reverse mortgage suits your needs. Our skilled team is here to navigate you through the evaluation process.

Read What Other Seniors Like You Have to Say!

Thousands of Canadian Seniors have already chosen a Reverse Mortgage for their retirement needs. Read here what they say about it!

Ken and Angela

John Mercer

Debbie Brinson